The French startup ecosystem is booming. With €5.2bn raised since 2014 and more to come, France is one of the hottest tech hub in Europe.

We took a step back at Avolta Partners to analyze the data and wrote down 10 take-aways.

Click here to download the full report

1 – Cocorico! France is on its way to becoming the biggest European VC market

Future looks promising for the French startup ecosystem. In 2016, France has risen to the second rank in Europe, before Germany and right behind the UK, in terms of amounts invested. The total market have tripled from €926m in 2014 to €2.5bn in 2016 (!)

France might catch up with the UK very soon under the combined effect of the Brexit and the promise of new French mega rounds. From January to August 2017, French funds specialized in the Tech industry have already raised €2.7bn, compared to €2.5bn for British funds.

2 – The Venture Capital market is rational!

The market has learned from its mistakes and is on the road to profitability. Part of this comes from the standardization of valuation tools. Transaction multiples are now widely used by VCs to value startups.

However, this kind of information is scarcely available for entrepreneurs. In our 2017 Edition of Venture Transaction Multiples, we computed the Equity Value / Revenues multiples for 9 business models and 11 industries.

3 – The French market is healthy and offers promising returns

Avolta Partners has identified 2 trends that describe the booming French tech industry:

1. Investors are putting in more money: the average equity ticket size has risen from €2.4m in 2014 to €4.1m in 2016.

2. The median EV / Revenues multiple is shrinking. In 2016, VCs valued French startups 4.5 times their yearly revenues, compared to 5.4x in 2014.

VCs are investing more money, in bigger rounds but are keeping a cool head when it comes to startup valuations. These are very positive signs that a healthy VC market is building up in France, with promising ROI for the coming years.

Click here to download the full report

4 – Winners take it all: 10% deals drive 60% investments

Investments in the French ecosystem are concentrating, to such an extent that in 2016, 10% deals drove 60% of total investments. Year over year, rounds are getting bigger.

And it is good news for VC returns. By concentrating investments in leader startups, VCs are making up for their losses on the long tail and optimizing their returns.

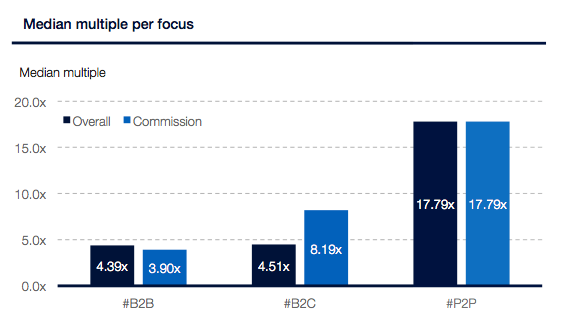

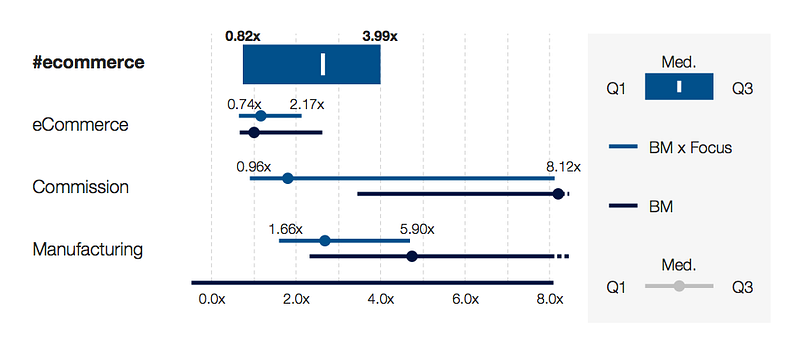

5 – P2P commission-based models are valued up to 18 times their revenues!

Among all the business models, commission-based startups are generally very well-valued. For instance, the median multiple for commission is 8.26x revenues, compared to 4.49x for subscription and 1.14x for ecommerce.

However, even more impressive are P2P commission-based startups such as Drivy, Ouicar, Stootie, Blablacar, Lendix. They are on average valued 17.79 times their revenues. Investors appreciate their scalability, large user base, strong repeat business and efficient user acquisition.

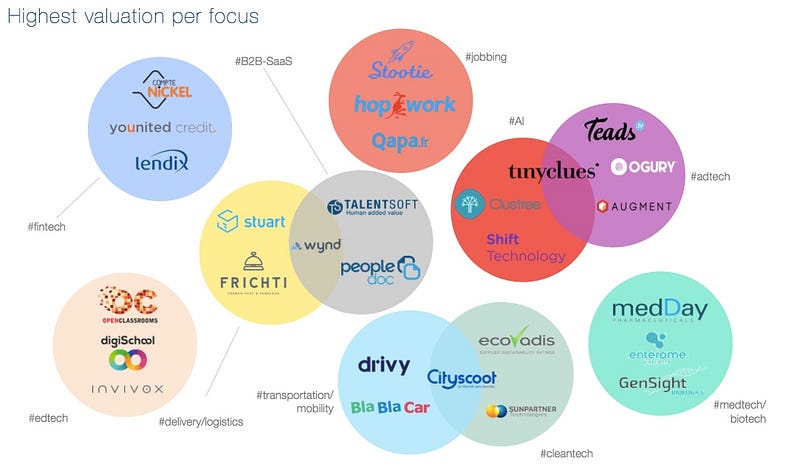

6 – AI is booming but investors are acting cautiously around it

Artificial intelligence is the hot topic in 2017. Countless new business applications and the prospect of successful exits in the coming years are seducing investors.

Already €115m (30+ deals) have been raised since January compared to only €10m in 2014. Given the youth of deep tech, pre-revenues deals are very common: 48% of AI deals in 2016 vs 34% overall.

However, investors are still cautious when it comes to valuation: AI startups are valued 3.5 their revenues, slightly below the cross-sector average! But for how long ? This multiple is based on 2014–16 operations but 2017 multiples might be skyrocketing as investors better understand the value of AI.

7 – eCommerce is a well-established model

eCommerce is an important sector in venture capital (€134m raised in 2016 for 66 deals) but it is a very mature market and valuation multiples are low (1.5x median).

Investors fear these businesses with low gross margins, hard-to-scale revenue and high fixed costs related to logistics. They tend to commit smaller tickets for companies with higher revenue, typically focusing on profitable businesses with critical size as M&A opportunities decreased in this market.

Click here to download the full report

8 – Don’t trust what you read : beware of the “new money bullshit gap”!

The “new money bullshit gap” is the difference between the amount disclosed to the public and the actual equity raised.

Hold on to your hat: publicly released figures are inflated by 32% on average. However, startups are not necessarily to be blamed for that.

First, amounts communicated in the press do not stick to the pure-equity view and often include non-equity money such as subsidies or debt-like instruments.

Alternatively, startups also tend to communicate on full-round amounts even if the fundraising is actually done tranche by tranche and that only a part of it has been effectively secured.

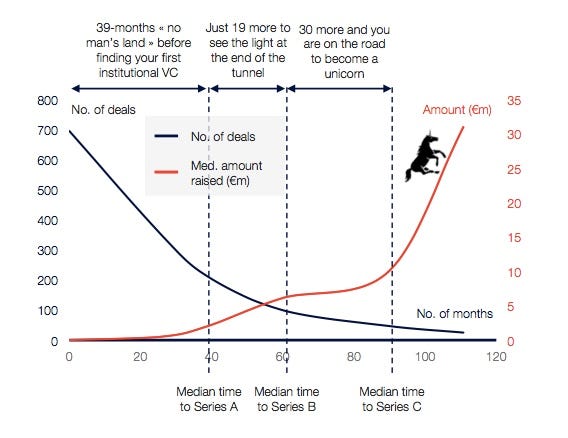

9 – Fundraising remains a bumpy journey for entrepreneurs

Playing in the big leagues takes relentless efforts. On average, entrepreneurs encounter a 39-months “no man’s land” before being funded by their first institutional VC. After which, they have to overcome the “Series B” obstacle, which takes on average an additional 19-months.

Beyond this point, the access to capital becomes easier for the companies needing additional equity financing. You’re on the road to becoming a unicooooorn!

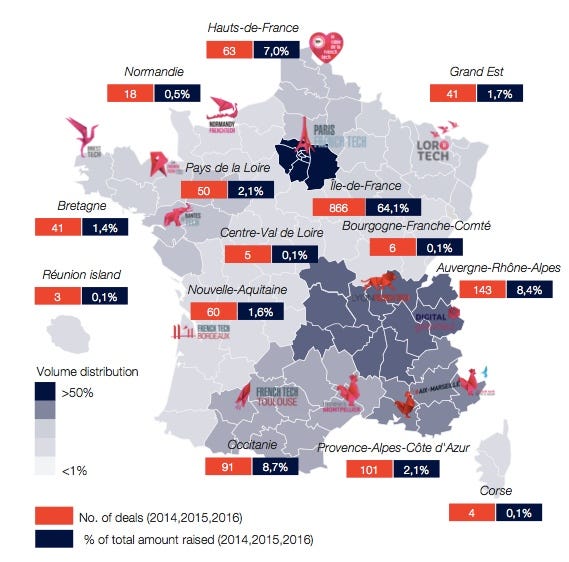

10 – Regional hubs are building up

As the French VC market is booming, strong regional hubs are building up. 4 years after the launch of the FrenchTech initiative in 2013, results are impressive. This accreditation awarded to French cities has helped regional startup ecosystems to structure themselves.

The Paris area has kept a crushing leading position with 64.% of the entire volume raised and 58% of total deals. However some very active challengers have stood out: Auvergne Rhône-Alpes with Lyon and Grenoble, PACA with Aix-Marseille and Occitanie with Toulouse and Montpellier.