Decision making in VC is a difficult process because we decide in an environment full of uncertainties. Ten years ago, it was uncertain whether or not businesses would be ready to send most of their data into the cloud and access software directly from the browser. Today, it is uncertain whether a machine will answer a significant share of a call center’s incoming calls — but we believe in it. Most of our daily job as VCs consists of identifying these uncertainties and spending time on trying to build a strong enough conviction on what the distribution of outcomes might look like. Why? Because this drives investment decisions.

For entrepreneurs, understanding the decision-making process of a VC is perhaps equally complex. Doing so is nonetheless the key to assessing their chances of raising VC money. At Point Nine, we are aware of entrepreneurs’ need for transparency and this is why we’ve published a few posts about our investment thesis, made our internal deal memos public, or even created some (in)famous funding napkins (SaaS and Marketplace).

But we are not the only one; most of the experienced investors have also become more vocal about their own investment principles. If you’re curious why, check out this post I wrote some time ago.

The simple exercise I run in this post consists in combining a few frameworks I’ve learned either doing the job at Point Nine, at Alven, or reading posts from some of the most famous VC firms online.

After reading ten(s) of posts about VCs’ investments principles, I ended up with a simple framework with 5 categories (or 5 Ts) outlining how VCs think about:

- The Team

- The Tech (a.k.a. Product)

- The Total Addressable Market (a.k.a. Market)

- The Traction (a.k.a. Growth)

- The moaTs (a.k.a. Defensibility) — if you know a synonym of moats starting with a T, please tell me!

The idea of exposing this framework is two-fold. First, by scoring investment opportunities according to these 5 criteria, I might be able to arrive at a ‘more rational’ investment decision myself. Second, I might be able to help entrepreneurs better assess their chances to raise VC money.

At a high level, this framework seems to be consistent with the traditional mental process that we go through as VCs before making an investment decision.

I also created a TL;DR version of this post, which is a Typeform calculator. If you have no time to read this post, but still want to assess your chances to raise VC money, just click the image on the left.

That being said, most of the answers and the formula behind the calculator are mentioned below, so if you want to score highly, it’s probably best to skim through this post briefly!

The scoring system is entirely arbitrary but it might make the experience of reading this post a little more enjoyable.

T #1 — Team

1. “There is always a secret at the core of every business”

The best startup teams own a secret. If you look at the startup ecosystem as an efficient capital market — I know it’s not completely — “there is no free lunch”. Hence, opportunities that are too obvious will likely be too competitive or already optimally priced by the VC market. We believe that founders who have first-hand experience of the problem they’re trying to solve approach this problem with an information advantage over the market.

VC Compatibility Calculator: Add +1 if you think that you have an information advantage versus the market due to unique market insights, better access to technology/data or stakeholders in your industry.

2. Purpose

Building a startup is hard. Founders with a purpose are resilient and will find other reasons than financial ones to survive the difficult days. I could not find a better way to put it than Homebrew in their investment thesis: “We believe that being mission-driven is a competitive advantage for an entrepreneur. Mission-driven founders are better recruiters — they can explain the “why” and not just the “what” and “how” of their vision. Their convictions make them better leaders, and their employees more loyal, through the ups and downs of startup life. Their passion adds energy to every room and every team.”

VC Compatibility Calculator: Add +1 if you’re on a mission to bring a specific idea to the market.

3. Leaders + Managers + Doers

Now, if we dive deeper into the characteristics of successful founding teams, I would agree with Jean de La Rochebrochard at Kima Ventures when he writes that “a company needs honest Leaders, Managers, and Doers”. Having a strong leader is all the more necessary in that it helps startups to hire, sell and fundraise.

VC Compatibility Calculator: Add +1 if there is one strong leader, another +1 if there is one manager, and another +1 if there is Doer.

4. Decision Making

Startup founders need to be able to listen to feedback from employees, customers and their board. Nonetheless, this feedback can sometimes be misleading and contradictory. Hence, founders also need to say “no” and have good decision making skills — Tom Tunguz’s post on that is great. A wise man I recently met summarizes this decision making ability in having “a f*ck you attitude”. Yes, saying “no” to your employees, “no” to your customers, “no” to your investors can sometime be the right way to go!

VC Compatibility Calculator: Add +1 if you believe there is someone in the founding team with good decision making skills.

5. Learning curves

“One must learn to assess the learning curve of young founders as a primary reason to decide whether or not to invest into them.” Across the startup journey, founders will make mistakes. The best of them can spot mistakes, reflect upon them, and become better. As long-term investors, we put more emphasis on understanding the trajectory that founders are on than on the discrete point they find themselves in at the point of the investment.

VC Compatibility Calculator: Add +1 if you work in fast iteration cycles and can integrate feedback quickly.

Total T#1 = Secret, Mission, Leader + Managers + Doers, Decision Making, Learning Curves / 7

Now, that you have the right team and scored highly on the team assessment part, let’s try to understand if you are building the right product.

T#2 — Tech (aka Product)

1. Product Picker

This part is a good transition between team and product. If you don’t know what a product picker is, I would really recommend giving Michael Wolfe’s post: “The most important job in Technology” a good read. Said briefly, a product picker is someone with great product instincts, someone who understands the needs of the users and the overall vision of the company to make the right product choices in a timely manner. Having such a person early on in a startup team is an invaluable strength and we can often see that looking at the product velocity of a startup.

VC Compatibility Calculator: Add +1 if there is one great product picker in your team.

2. 10x better AND cheaper

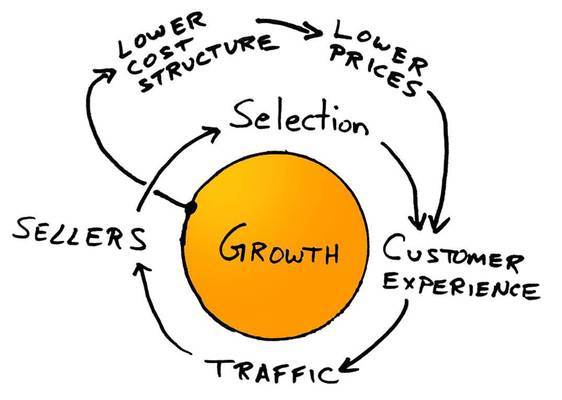

Marketplaces like Uber and AirBnB, as well as SaaS products like Salesforce won in their respective markets because they could offer a product with a much better user experience than their competitors whilst leveraging technology to have a much better cost structure as a company enabling them to offer better prices. Uber did not create private drivers, they just made it available “as tap water”, and at a competitive price because they leveraged technology. 10x Better AND cheaper. As Benchmark’s Sarah Tavel explains well, the devil is in the AND. I’ll try not to say more, because you should really read her post!

VC Compatibility Calculator: Add +3 if your product is 10x better AND cheaper. Why+3? This is VERY rare but when this happens, this is a very powerful driver of growth and defensibility.

3. Fast product iterations

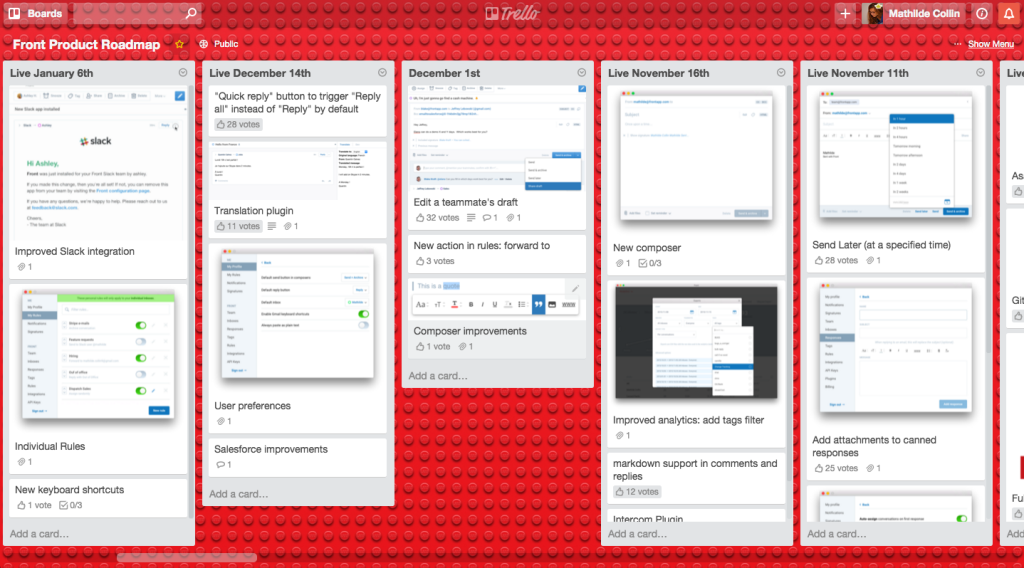

Just like with teams, in the early days what matters when it comes to technology is the trajectory, not the current status of the company. Hence, i) knowing how to prioritise between product features, ii) releasing often, iii) being able to integrate user feedback fast and iv) working on weekly product sprints is a great advantage in the early days. Yes, that’s a long list of things to get right!

VC Compatibility Calculator: Add +1 if you work on weekly sprint iterations and consider that you can test product hypotheses quickly.

4. How critical is your product for your (future) customers?

Last but not least, building a 10x better and cheaper product matters only if it is critical for the customers.

VC Compatibility Calculator: Add +1 if your product is a must have (vs. a nice to have) for your customers.

Total T#2 = Product Picker, 10x Better AND Cheaper, Speed of Product Iteration, Criticality of your Product / 6

Ok, well done, now you have the right team and the right product. Let’s see if you’re going after the right market!

T#3 — TAM (aka Market)

1. Large markets

Union Square Venture’s investment thesis fits in 140 characters: USV “invests in large networks of engaged users, differentiated by user experience, and defensible th(r)ough network effects” But what does “large”mean? Most VCs would agree that bottom-up wins over top-down market sizing. For SaaS, Christoph summarizes what we look for as follows: “We’re looking for markets that consist of at least 3,000 whales ($1M ACV), 30,000 elephants ($100k ACV), 300,000 deer ($10k ACV) or 3M rabbits ($1k ACV)”. WTF are these animals? (Check here). How does it work with marketplace businesses? Just exchange ACV by (AOV X take rate) and the # of animals by (Transaction frequency/user X # of users).

Bottom line, VCs look for multi-billion dollar markets. That said, the more industry specific or vertical (vs. horizontal) a startup is, the more likely it is that a company can own a significant market share (>15%) because of a lower expected competitive intensity. As a consequence, VCs’ expectations regarding market sizes are lower for industry specific solutions — think $1bn markets for vertical solution vs. multi billion dollar markets for horizontal ones.

If you’re a SaaS company there is a high likelihood that you’ll need to hunt animals in the US (aka you need to win the US market). Why? Because more than half of the current software spending per year comes from the US.

VC Compatibility Calculator: Add +1 if your bottom up TAM is above a billion for vertical startups, in billions for horizontal ones, and add another +1 if you have a chance to win the US market.

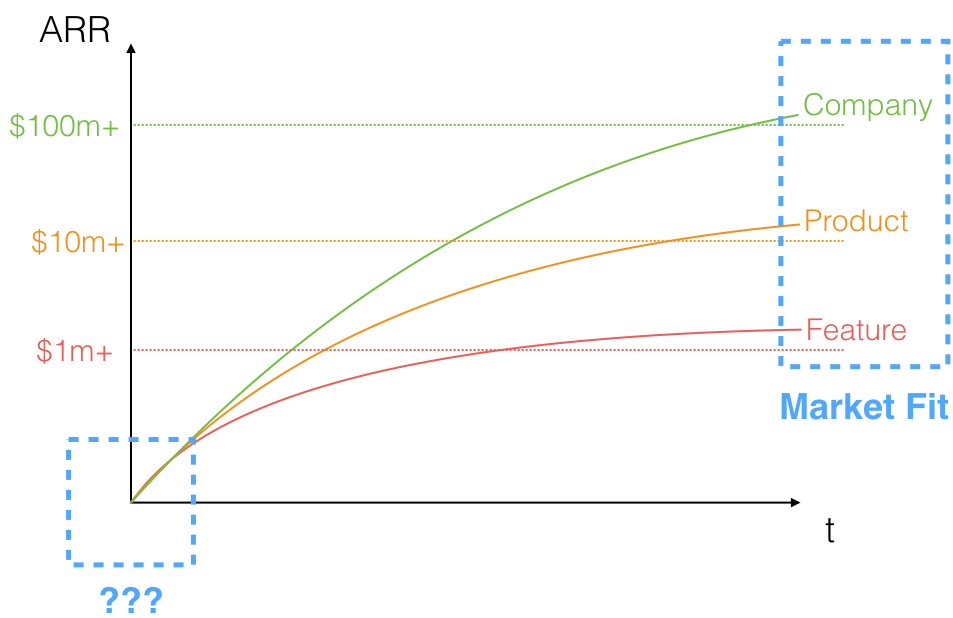

2. Feature/product/real company (aka how high is the ceiling?)

The reality is that market sizing is always a complex exercise. Why? Because “Innovative tech companies typically disrupt an existing market by undercutting the incumbents on the one hand (and hence shrinking the market), while creating a new use case attracting a larger number of new users on the other hand”. Hence, being a little creative around market shrinkage and long term market expansion is especially important. An interesting way to look at the potential for market expansion is then to think about a startup as either a feature (stalling at 1M ARR) / a product (10M ARR) / real company (100M ARR) — see Nico’s post for more here.

VC Compatibility Calculator: Add +1 if you have enough crazy ideas on your product roadmap to build a “real company”.

I know this question might be VERY difficult to answer in the early days of a startup. One way to look at it is to think about the current product features of Salesforce and ask yourself if there is enough demand/space in your market to develop such a complete product in 10 years!

3. Optionality / Macro trend

Now that your market seems big enough on paper, how do you get to the billion dollar market capitalisation? There needs to be something like a macro trend that transforms a great company into a truly exceptional company.When you think about Zendesk, beyond a great product, beyond the founders’ execution capabilities, couldn’t we argue that the shift towards a more “customer centric” world has also increased the market appetite for helpdesks and thus made the company even more successful?

VC Compatibility Calculator: Add +1 if you can already foresee that you could ride a macro trend which might push your growth once you’ve reached a certain size.

Total T#3 = $ Bn Market + US, Real Company, Optionality / 4

Ok, well done, the market is big enough. Let’s now wonder about how your startup will grow and gain market share. Because, as Nakul Mandan from Lightspeed writes in his own investment thesis, “Ultimately, startups are valued for growth”. Hence, we try to understand what could drive a company to grow from 0 to 1M, from 1 to 10M, and from 1 to 100M and how much cash each of these steps would require.

T#4 — Traction (aka Growth)

1. Market timing: “Is your market in pull or push mode?”

It’s always easier to sell if markets are in “pull mode”, ie. when your next clients are already looking for a solution like yours. In “push mode” you will need to convince them that your solution fits a need that they don’t know about.

VC Compatibility Calculator: Add +1 if your market is in “pull” mode

2. Distribution advantage

Keeping customer acquisition costs low at scale is often very difficult.

Why? Because startups need to convince later stage users that are less keen to buy or who are more difficult to find on online channels, and/or because competition will likely push down margins.

This explains why “the largest outcomes tend to have one common feature: something in their core product allows them to grow faster over time, while bringing acquisition costs lower”.

Digging deeper, we can outline three ways to overcome distribution challenges:

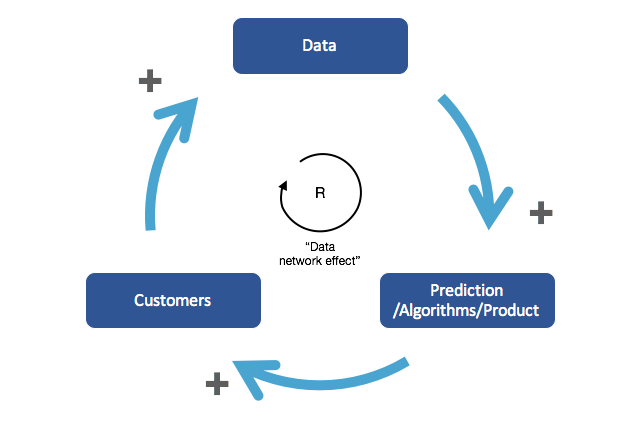

- The product becomes better with time because the product has intrinsic network effects. It can be either a network of people for a marketplace or a network of data for AI products (see USV Andy Weissman’s post here). Startups can keep on acquiring later stage users because they “provide a better experience to customer ‘n+1000’ than they did to customer ‘n’ directly as a function of adding 1000 more participants to the market” — it’s not my definition, it’s Bill Gurley’s here 😉

- The product is intrinsically viral: the more users there are, the more people are exposed to the product (eg. Typeform, Venmo).

- Or channel partners become multiplicators after a startup has reached a certain scale. Tom Tunguz published an interesting post about that earlier this year. Xero and Bench are interesting examples that fit this category.

VC Compatibility Calculator: Add +1 per source of distribution advantage.

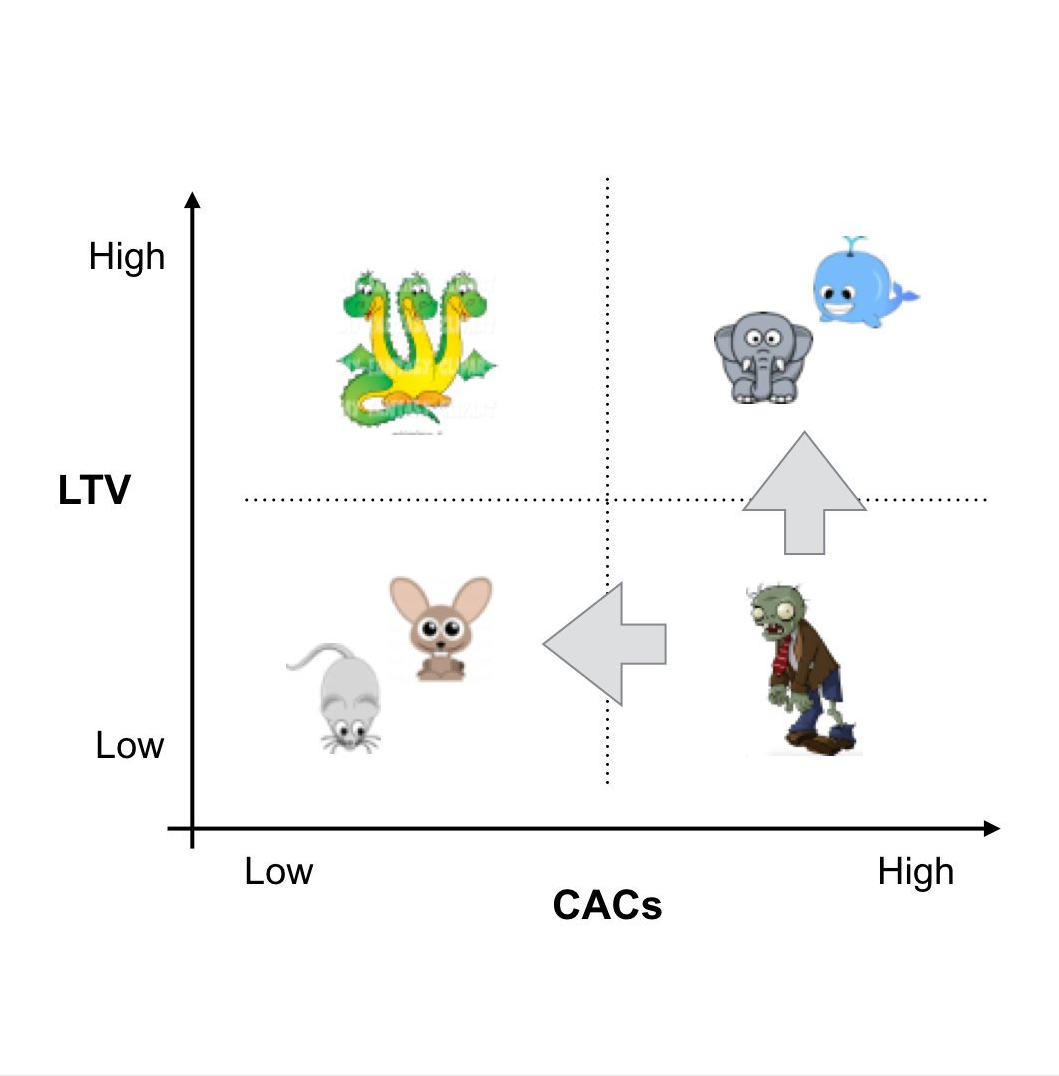

3. Avoid the graveyard of low LTV and high CAC

Last but not least, growth costs money and beyond VC money, the only way to finance it will be to maintain healthy unit economics at scale. In SaaS and marketplaces, this means aiming at a good enough CAC/LTV ratio to avoid what Christoph calls “the graveyard of high CAC vs low LTV”. If you have little chances to benefit from the distribution advantages mentioned above, you can still get extra points if you can charge 100k-1M ACV because you’ll be able to spend big money on sales and marketing. What matters here is not the unit economics at the Seed stage but much more what these could look like post Series A.

VC Compatibility Calculator: Add +2 if you have an idea on how you’ll avoid the graveyard! You can be creative 🙂

Why +2? Because it’s almost the most important question.

Total = Pull/Push + Network Effect + Virality + Potential for channel partners + Healthy Unit Economics at scale = /6

Ok, now you have a great team, you’ve built a great product, your market is large and looks for a solution like yours. All in all, you have a great business, but what will prevent greedy incumbents or new players from attacking your rent? Moats. This is why any investor will try to understand the types of moats a startup could be building with time.

T#5 — moaTs (aka Defensibility)

Sources of defensibility are not mutually exclusive and each of them is questionable per se (see this 2011’s post: “How strong are network effects online, REALLY?” or my most recent post “Routes to defensibility for your AI startup”). But here is a non-exhaustive list of sources of defensibility:

1. Network effects

AirBnB is defensible today because they have the largest inventory of private housing and the largest amount of demand for private housing. They have won consumer trust, built strong user habits and own the supply side by driving consistently high volumes of paying leads.

2. Data network effects

ML products become better as they ingest more data. If you own the data that is required to train a ML-powered product, and nobody else does, chances are high that greedy incumbents won’t be able to build a product as great as yours.

3. Superior technology / protected IP

Another way to prevent competition is to have a unique technology that is just very difficult to copy, which could be patented or not. Patents for new drugs in the pharma industries are a good example of protected IP.

4. User or Data lock in

This is more questionable, but switching costs increase with the amount of data that is stored and locked within a product. If you have all your contacts or deals in Salesforce, and can’t export it, you’ll likely think twice before switching CRM. The defensibility of a product is also correlated with the number of users on the platform. If your entire company has been using and collaborating on Zendesk for a few years, it might not be that easy to change your ticketing software.

5. Brand or Mindshare

This one might be as controversial as this is intangible. Nonetheless, we could argue that once companies become top of my mind for their customers, they’re simply not looking for alternatives — remember the last time you used Bing for search?

6. Economies of scale

Last is Economies of Scale (which is different than network effect). Once startups get bigger, they lower their break-even points, increase their bargaining power to increase prices, decrease costs, and protect themselves from new envious startups willing to enter the space. Did you ever think about starting a book marketplace?

VC Compatibility Calculator: Add +1 per source of defensibility

Total = Network effect, Data Network Effect, Superior Technology, User or Data lock-in, Brand, Economies of Scale = /7

Total

Team = /7

Tech = /6

TAM = /4

Traction = /6

moaTs = /7

Total = /30

Congrats for finishing the post! Time to test it on your own company?

Just click the image below!

The last extra point I would like to mention to finish this post is a quote from Fred Wilson:

As a VC, “You have to figure out how to insert yourself into that journey in a way that is constructive and value adding. And you have to do that work before you invest because if you can’t figure out how to play a role that is constructive and value adding, you should not make that investment and join that Board.”

I would probably add +1 here as well, but this is not a question for founders 😉

I hope this post brings a little more transparency into the decision making process that we go through as VCs.